http://urbansurvival.com/week.htmReader writes to George Ure...

Here's a good one:

Hello, George- Do enjoy reading your website. Found it interesting that some people are wondering IF this nation has stepped upon the slippery slope of totalitarianism. Must truly be asleep at the wheel, if anyone actually needs to ask this question they are most definitely in need of removing their blinders. What is more important is WHY would this nation be rushing into the arms of totalitarianism.

The short answer is that our nation has actually invented a new sect of fascism for itself. This sect is somewhat different from previous fascist states in that it finds it useful to pander to the traditions of a dead republic, yet as a fascist enterprise, it cannot help but gobble up every impediment to absolute power. The long answer is that our ruling oilogarchy long ago chose war to fuel the economy, directly and indirectly.

The racket of war has been praised by every president since Jackson, and war in the dead republic is all about the enrichment of well connected corporate "contractors". The oilogarchy chose war to control the social order. It chose war to enrich u.s. corporations at the expense of invaded and decimated lands. Only one little problem with the total war mentality of the dead republic, despite all the hubris, the dead republic cannot win any more wars. In fact, similar to most military first, aggressive fascist states, the way to the fall is through military defeat.

Thus, the Iraq debacle, where the occupational forces must hold up in their fort to be safe. Thus Afghanistan, where indigenous, poorly armed and trained warriors are defeating the shining army, one day at a time. The greatest ruse of the dead republic is the false claim of rule by the people, for the people. In our fascist state, it is the corporation which stands supreme, and government which is the corporate boy.

Obama does not dare remove BP from their leadership role in murdering our oceans, he must be a good little messenger for the giant multinationals, and look, indeed he is. The chapter we are facing now certainly appears to be summarized by the old proverb-what comes around goes around.

Going now on 200 years of devastating nations and taking their wealth, is it any real surprise that the PTB would finally focus their jaded eye on the nation that hosted the slaughter? Of course it is inevitable that the cannibals who are slaughtering our nation must lean toward totalitarianism. The propaganda network can only hold the masses in check for so long once the beer, food, and shelter disappears into the pockets of the fascists.

Well, we've seen the war on Communism, the war on poverty, the war on drugs, and the war on terror-which by the way is absurd-Terror is a tactic, not a person, place, or thing. It is a functional impossibility to wage war on a tactic. Perhaps the latest unleashed by our fascist elite should be called the war on U.S.

Kind of echoes my own sentiments, almost exactly...

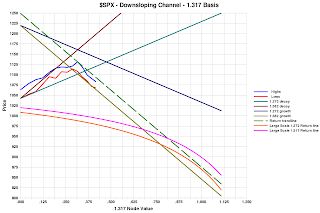

Same color scheme protocols as the $SPX charts in the previous post...Notice that the $RUT has been a little better behaved relative to the lower side of it's channel then the $SPX (see earlier post) which has briefly broken down below it's channel and has been trying to climb back into it....The Russell 2000 channel is also a little wider then it's $SPX counterpart....

Same color scheme protocols as the $SPX charts in the previous post...Notice that the $RUT has been a little better behaved relative to the lower side of it's channel then the $SPX (see earlier post) which has briefly broken down below it's channel and has been trying to climb back into it....The Russell 2000 channel is also a little wider then it's $SPX counterpart....